Banking & Financial Service (BFS)

Banking & Financial Service (BFS)

Accelerating the cashless economy efficiently by adopting global standards & local priorities

The Banking and Financial Services (BFS) Group at NeST Digital has established itself with over two decades of experience as a pioneer and leader in the GCC market by providing payment platform solutions – advanced payment solutions based on scalable microarchitecture & technology implemented to over 30 leading financial institutions is a testimony to its established credentials.

NeST NPSS Edge

NeST Digital provides turn-key innovative and customized data solutions leveraging our internal specialized data team and partners. We offer flexible engagement and commercial models to meet the needs of their clients.

Experience in Banking & Financial Service

- NeST NPSS edge is an outcome-based product which meets the growing GCC market enabling the next generation of payment services for safe, innovative, and convenient real-time electronic payments across 24/7/365

- NPSS Edge provides core services (credit transfers & direct debits), overlay services, & addressing services like ETDA, request to pay, and electronic cheques

- Key differentiator – Reports like NPSS reports, MIS report, CPR Report, recon reports, Liquidity monitoring and management that include smart dashboards, extensive audit trails, TAT Alerts, log monitoring dashboards (workflow & Rule config), reconciliation module, flexible & dynamic charges module

Integrated Payment Hub strategy for the future of the payment ecosystem, backed by Kubernetes microservices architecture which is scalable to maintain the SLA & growth of transactions and provides high availability to the financial institutions

Tech stack includes: .NET core, Java, Kafka Openshift, Azure DevOps, GitHub & more

- NeST NPSS edge is an outcome-based product which meets the growing GCC market enabling the next generation of payment services for safe, innovative, and convenient real-time electronic payments across 24/7/365

- NPSS Edge provides core services (credit transfers & direct debits), overlay services, & addressing services like ETDA, request to pay, and electronic cheques

- Key differentiator – Reports like NPSS reports, MIS report, CPR Report, recon reports, Liquidity monitoring and management that include smart dashboards, extensive audit trails, TAT Alerts, log monitoring dashboards (workflow & Rule config), reconciliation module, flexible & dynamic charges module

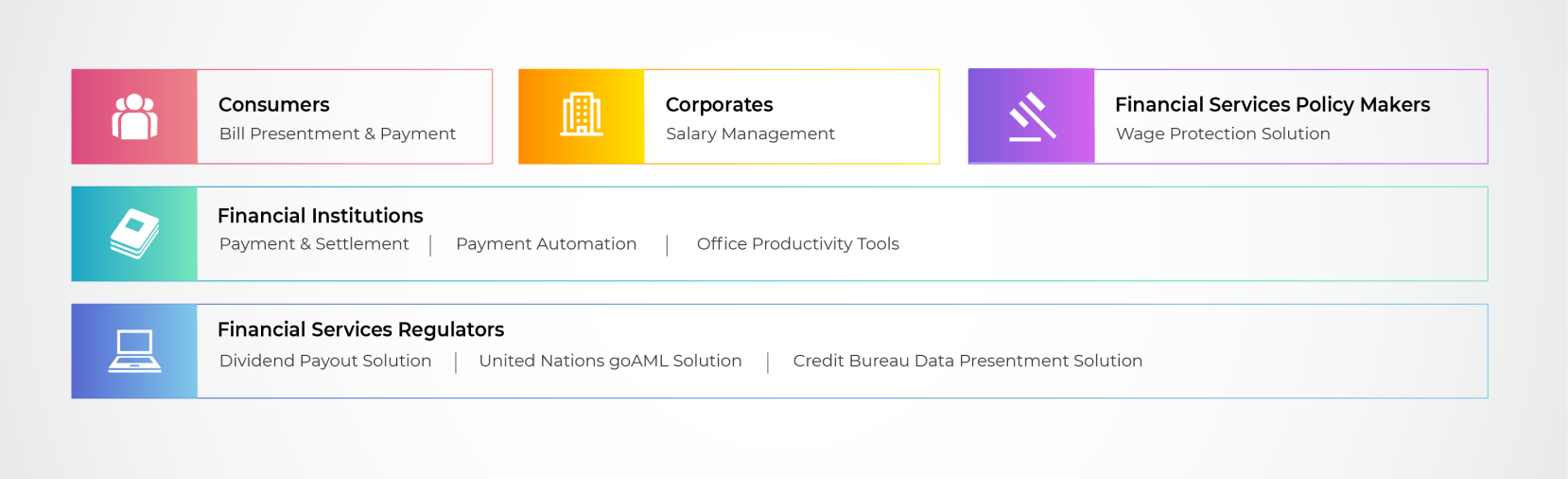

Product Portfolio

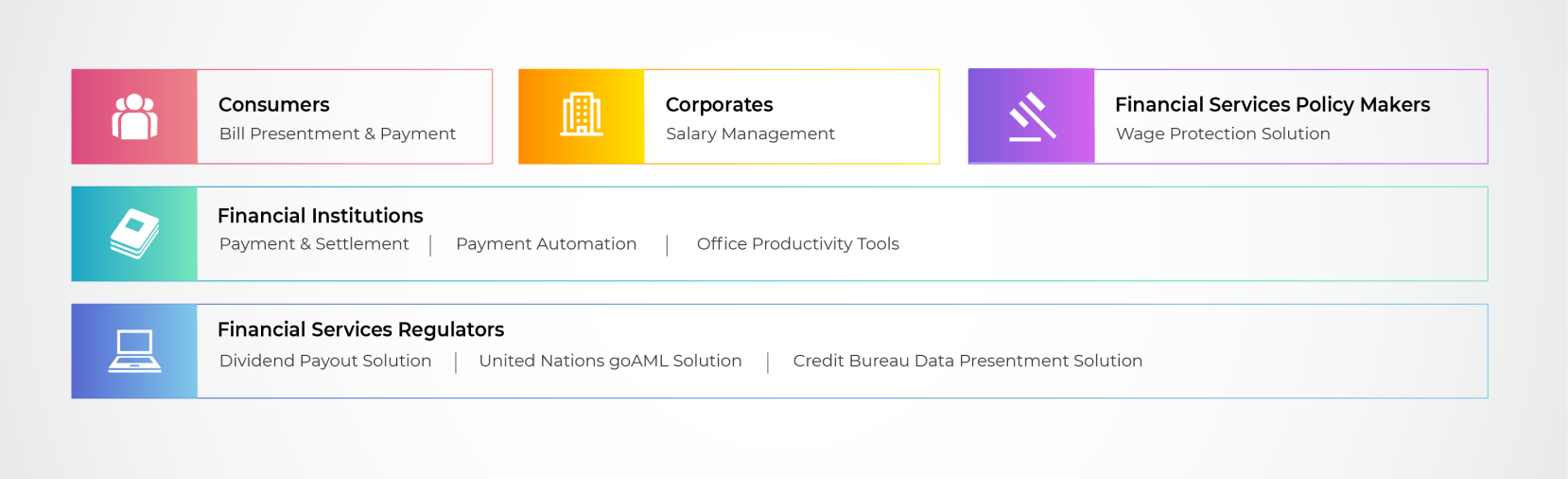

We, the Fintech group of NeST Digital, provide technology solutions to multiple domain stakeholders; and these solutions have been grouped into five solution pillars as follows:

Payment & Settlement

Advanced payment services with Central Bank’s Instant Payment system, enhancing customer experience & optimizing operations. (NeST NPSS EDGE, NeST DDS eDGE, NeST FTS eDGE Plus, NeST ICCS eDGE, NeST eCheque Management Suite, NeST EFTS eDGE)

Payment Automation

A framework configured to address any type of payment automation requirements in banks, financial institutions, corporations, etc. (H2H Transactions Automation, Immediate Payment Interface (WSI IPI))

Office Productivity Tools

A secure & faster one-stop solution for generating electronic statements from various input applications. (Smart PDF/ Interactive PDF, NeST eSAFE eDGE)

Dividend Payout

A robust automation solution suite designed for dividend payments through Stock Exchange Houses (NeST Dividend Management System (ADX)

goAML

Delivering current and future requirements of the goAML initiative from UNDOC and Central Banks of participating countries. (NeST goAML Suite)

Credit Bureau Data Presentment

Interface seamlessly with Credit Bureaus and share data pertaining to the customers’ credit history. (NeST AECB Interface)

Salary Management

An integrated solution where companies can deposit salaries into Prepaid Payroll cards through EFT. (E Card Based on Salary Management)

Bill Presentment & Payment

A common interfacing mechanism to channel systems such as Internet banking, Mobile Banking, and mobile wallet. (Biller Payee Module)

Quality Assurance Services

Offering includes software testing services that ensure business process assurance as well as technical assurance implemented through technology solutions. We have more than 3000+ test cases for NPSS products & have robust experience in test automation

KPIs:

• Test automation: 40% faster time to market

• Performance: Attain 99.999% application availability

• Agile Testing: Boost Dev productivity by 30%

• Cost Efficiency: Cut Cost of Quality by 20%

• Brand Value: Deliver 2X user experience than average

• Metrics Based testing: Reduce risk by 40%

Cloud & DevOps

Our Cloud & DevOps services combine software development and IT operations to deliver high-quality software faster. With a focus on automation and collaboration, we streamline your operations and eliminate manual errors, enabling you to achieve your business goals more efficiently.

KPIs:

• Highly Available: 99.99%

• Lead time: <1 Day

• Deployment Frequency: On Demand

• Infrastructure Cost: Reduced by 25%

• Time to restore: Reduced by 80%

• SaaS & Hybrid Cloud Ready

Data Management & Analytics

We assess the Bank’s current data and infrastructure state and provide recommendations to leverage data to measure digital transformation outcomes. In addition, we have the technical understanding to select the right-sized technology for your data modeling, cataloging, security, privacy, storage, and operational needs. Finally, we help you build a roadmap to build data intelligence that fuels using technologies like AI to improve insights, predict outcomes, or automate workflows

KPIs:

• Data volume: < 1 GB/day

• Latency: ~1 min

• Automated Reports: 100%

• CI/CD: 100%

• Licensing Cost: Nil

• SLA: 1 Hour

Cyber Security

NeST Digital’s Cyber Security offering provides Security Assessment, Security Exposure Remediation strategies and finally helps in putting appropriate controls in place to mitigate security risks

KPIs:

• Security Attacks: Reduced to Zero

• Data Privacy: 99.9%

• Regulatory Compliance: 100%

• Customer Security NPS: Improved to 9 – 10 (Promoter)

• Mean Time to Recovery: <6 Hours

Application Management Services

Custom application development, systems integration, and application maintenance support for financial services institutions

Product Engineering

Offering includes conceptualization of payment products & services design and developments for small fintech businesses and startups

Success Stories

Talk to our Banking & Financial Service experts today!